There are many new major functionalities and modules in D365 ERP which are not known to so many consultants yet and they still suggest modifications or other ISVs to their clients for these requirements. I recommend everyone to go through this article below so you have a high level understanding of the new capabilities added into the system. You might not get the depth of this yet but it will at least widen the horizon of your understanding.

sometimes, we don’t commit to new things but if someone introduce us to that new thing briefly, it opens up a window to a new world. I hope it will be that window for you as well.

Some of these new modules are introduced to meet specific IFRS requirements (IFRS 15 and IFRS 16), some are major new functionalities (Landed Cost, Rebate, ECM) and some are just performance enhancements (Planning optimization)

Here is a brief overview of these modules but I will try to cover it in detail in future blogs.

Revenue Recognition

This feature is a fantastic add into D365 ERP and helps the organizations to meet the requirements related to IFRS-15. Subscription is the new buzz word of today’s market. Everything is available in subscription model which means the customer will pay monthly OR they can pay lumpsum, but they can revoke the contract anytime, so ideally the revenue should not be recognized until that event has happened (which is called performance obligation in IFRS-15).

This is the 5 step model of IFRS-15 and I will explain this in detail in my next blog.

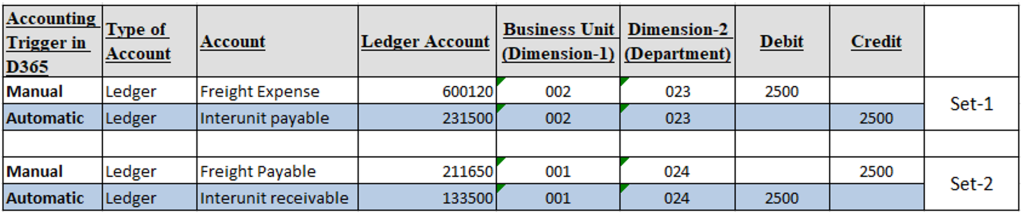

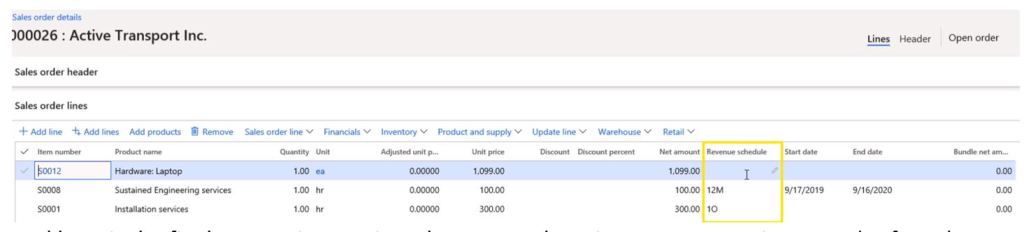

Here is a glimpse of change in the sales order and its posting due to this new functionality

Scenario- A computer company (e.g. Dell Inc) sells a laptop with 12 month support plan and installation service. The revenue for the laptop is immediately recognized (there is no revenue recognition schedule). The revenue for the support plan will be deferred and recognized over 12 months, as defined by the date range in the contract. The installation service will be recognized when the installation is done.

Revenue schedule feature has been added which can be linked to each line where we need to defer the revenue.

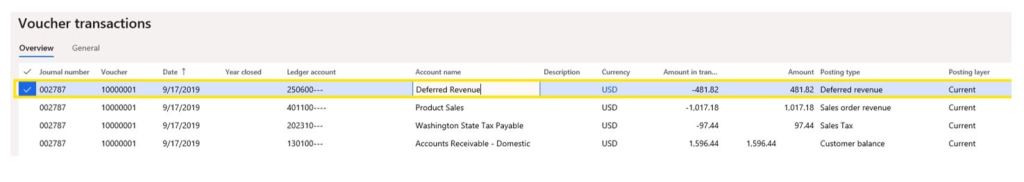

And here is the final accounting entries. Please note there is a new accounting entry (Deferred Revenue) which takes that portion of the revenue which is not recognized immediately.

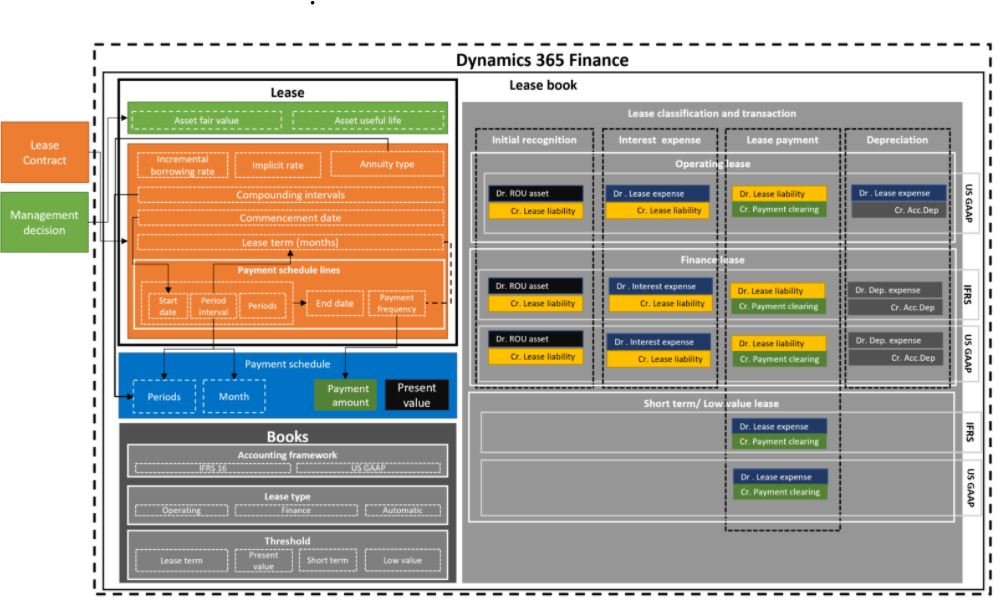

Lease Accounting

Asset leasing complies with International accounting standards (IFRS 16) and US GAAP standards (ASC 842).

IFRS 16 follows the approach of ‘right-of-use’ model. It means that if an organization has control over (or right to use) an asset they are renting, it will be treated as a lease for accounting purposes and must be recognised in the company’s books.

Now, it is not allowed for significant financial liabilities to be held off-balance sheet, as permitted for certain types of leases (operating leases) under the previous rules. The objective is to ensure that companies report information for all of their leased assets in a standardized way and bring transparency on companies’ lease assets and liabilities.

Microsoft has given a very detailed explanation and details of the new module in the following link-

https://docs.microsoft.com/en-us/dynamics365/finance/asset-leasing/asset-leasing-quick-start

here is a summary from the above website how this module handles the accounting for lease as per IFRS-16.

Credit Management Hold

Credit hold feature is a fantastic addition to the credit management module. This was acquired by Microsoft recently from a partner and it is very well integrated with standard features now. I have personally implemented it with two of our customers.

Here are the high level features in this module-

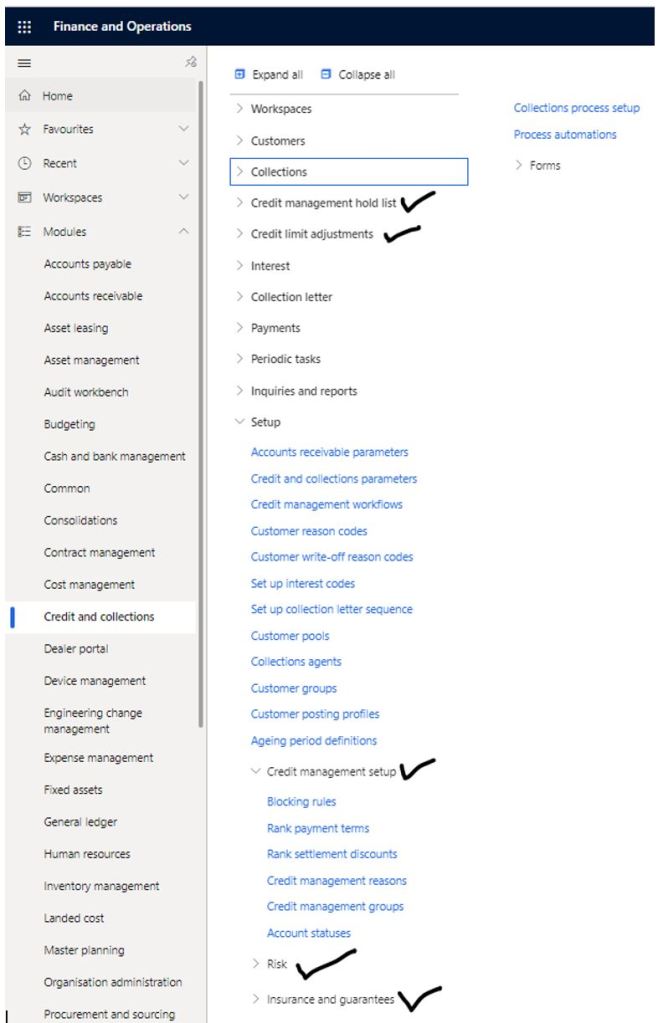

- Introduction of the credit hold functionality to block the sales order from further processing

- Configure different types of blocking rules-

- days overdue

- account status

- terms of payment

- expired credit limit

- overdue amount

- sales order (block orders more/less than certain amount)

- Functionality to clear the hold through workflow. (only applicable to sales order and does not cover free text invoice and project invoice)

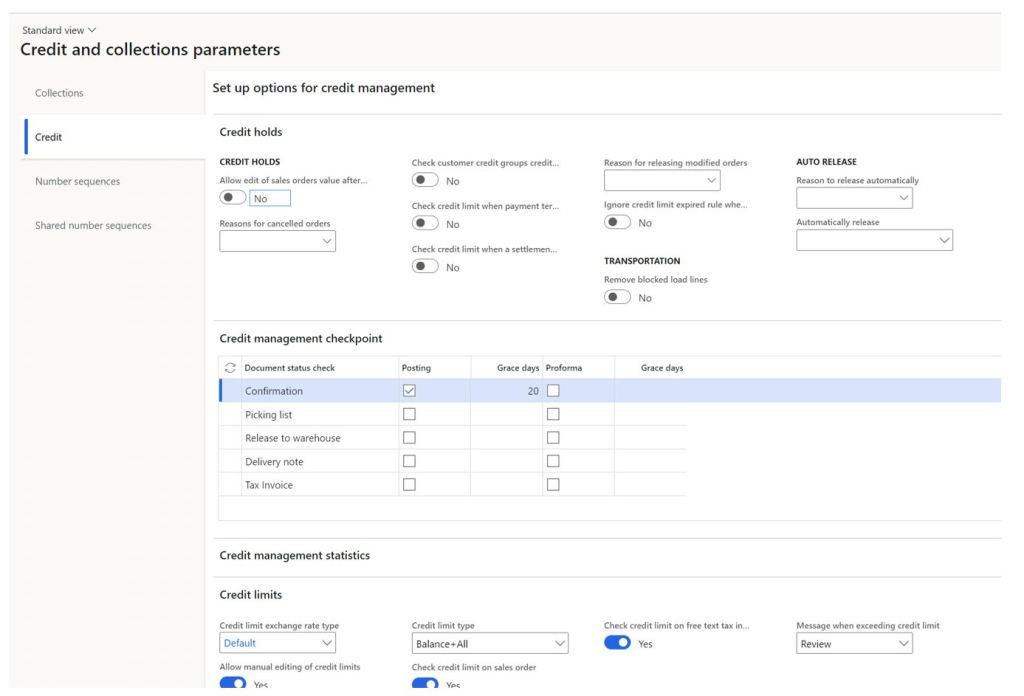

- Checking the credit limit at different checkpoints (e.g. order confirmation, picking list, release to warehouse, packing slip, invoice)

- Workflow on adjustment of credit limit and restrict manual editing of limit.

- Setting up the credit limit for group of customers. There is a new grouping which can be defined for customers across multiple legal entities)

- Temporary credit limit feature (to handle the peak season sales)

- Risk scoring based on certain parameters.

Here is the parameter screen where you can define the checkpoints for credit check.

New options and menus in the credit and collection module.

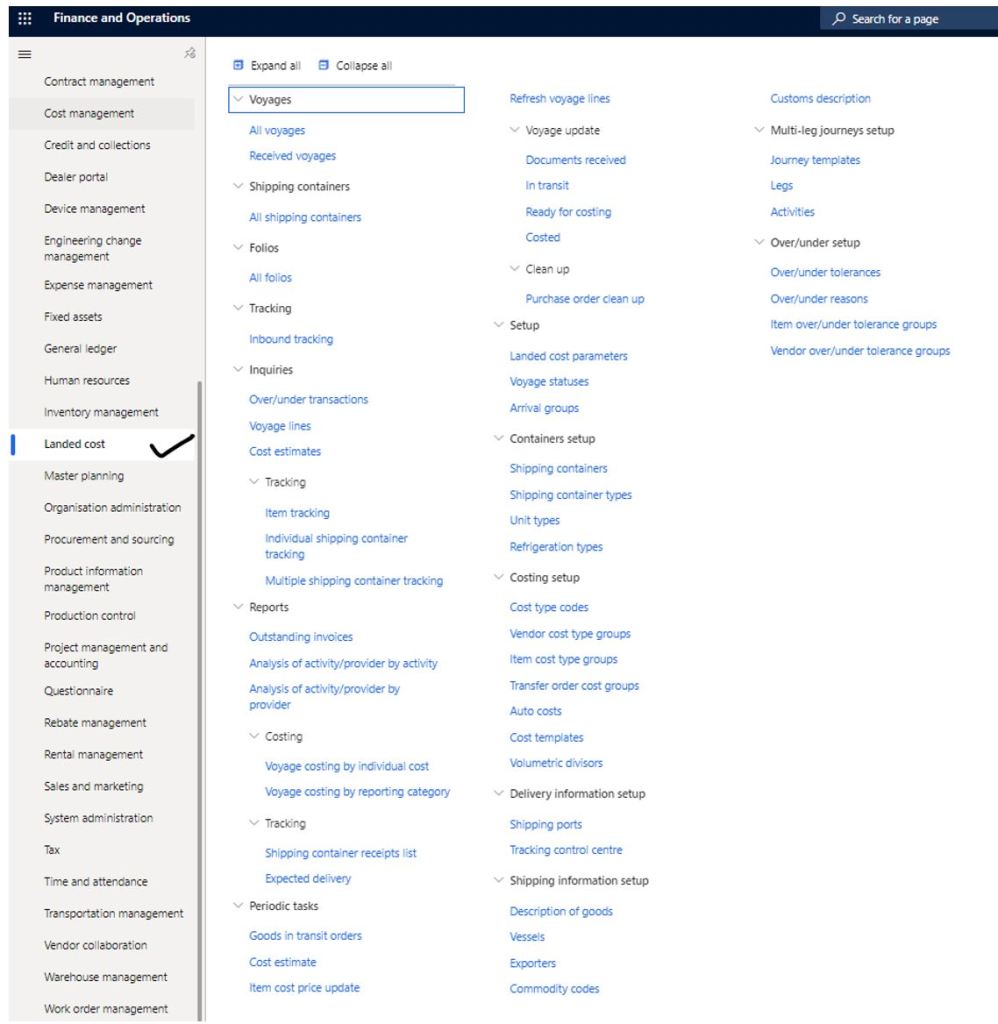

Landed Cost

This module is the most important addition in D365 in last few years. It was originally developed by an Australia based company ‘Sable37’ (acquired by DXC in 2018) and Microsoft bought the module recently.

Here are the high level features in this module:

- Estimate landed costs at the time of voyage/shipment creation. Multiple templates can be created, and standard cost can be published from there.

- Apportion landed costs to multiple items and purchase orders or transfer orders in a single voyage. (based on weight, volume, quantity, value, volumetric)

- Support the transfer of goods between physical locations by recognizing landed costs. (using transfer orders)

- Recognize accruals for goods in transit. We can invoice the purchase orders without receiving it physically which moves the goods in a transit warehouse and accrue the liability for FOB scenario.

See the details on Microsoft documents page and how this module works in comparison to the transport modules of D365.

https://docs.microsoft.com/en-us/dynamics365/supply-chain/landed-cost/landed-cost-vs-tms

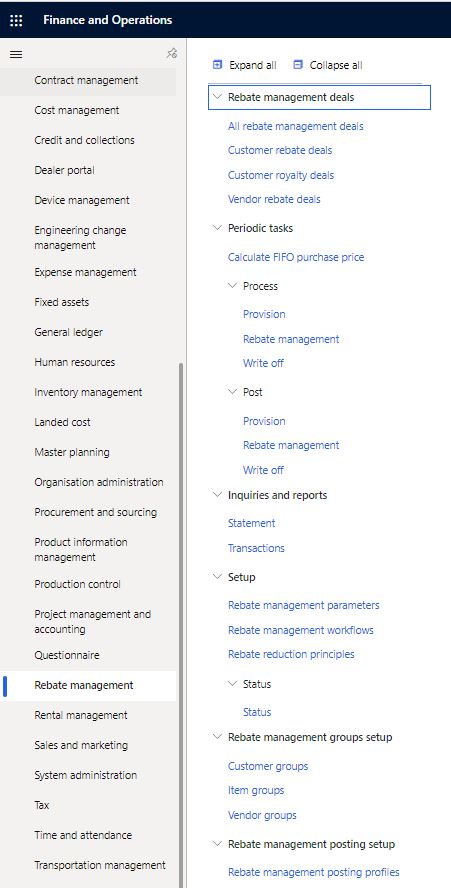

Rebate Management

Here is another module bought by Microsoft from DXC. D365 already had inbuilt capabilities on rebate management since ever but this new addition provides more flexibility and serves more scenario of rebate management. Interestingly, this new module is intendant of the existing capabilities which means that there are now two sets of rebate calculation mechanism in D365 now. There is no plan to deprecate the older functionality yet in the roadmap since many existing customers must be using that.

The main difference in the old and new module is that the new module does not calculate the rebate provision on the run time (i.e. when you post the sales order), rather you have a batch job to process it periodically or every day. I believe it is a problem in the new module but it should be just a temporary thing while both the functionalities do co-exist currently.

In other words, the old rebate functionality is very integrated at the transaction level but the new one is a periodic process and you don’t see the rebate amount when you see the margin etc. on the sales order.

No wonder, if you don’t see this module, since it has to be enabled from the feature management.

Here is some documentation from Microsoft

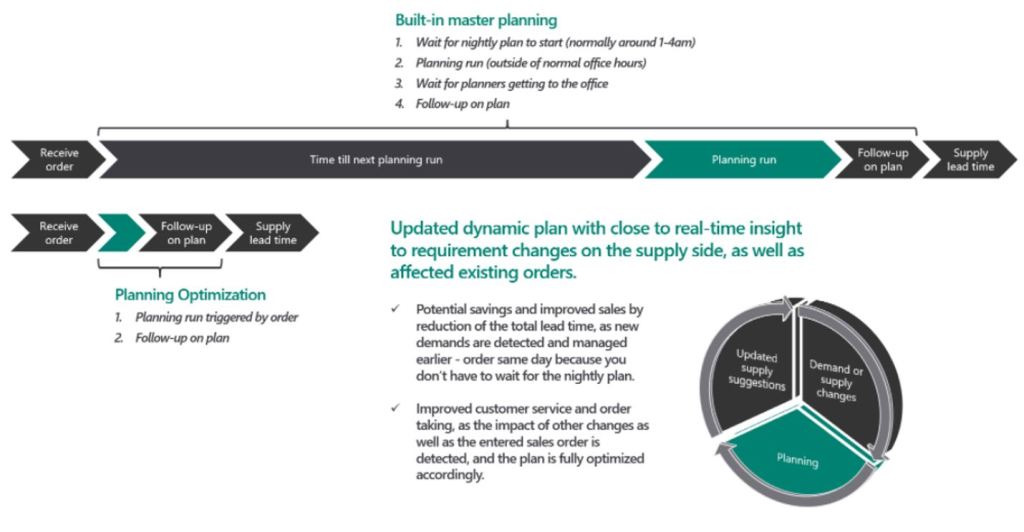

Planning optimization to replace traditional Master planning of D365

The traditional planning engine of D365 will be deprecated and ‘Planning optimization Add-in’ will replace it.

The Planning Optimization Add-in for Microsoft Dynamics 365 Supply Chain Management enables master planning calculation to occur outside Dynamics 365 Supply Chain Management and the related SQL database. The benefits that are associated with the Planning Optimization functionality include improved performance and minimal impact on SQL database during master planning runs. Quick planning runs can be done even during office hours, so that planners can immediately react to demand or parameter changes.

See the below image from MS website to understand the benefit of this.

See more details on Microsoft document page.

Master planning home page – Supply Chain Management | Dynamics 365 | Microsoft Docs

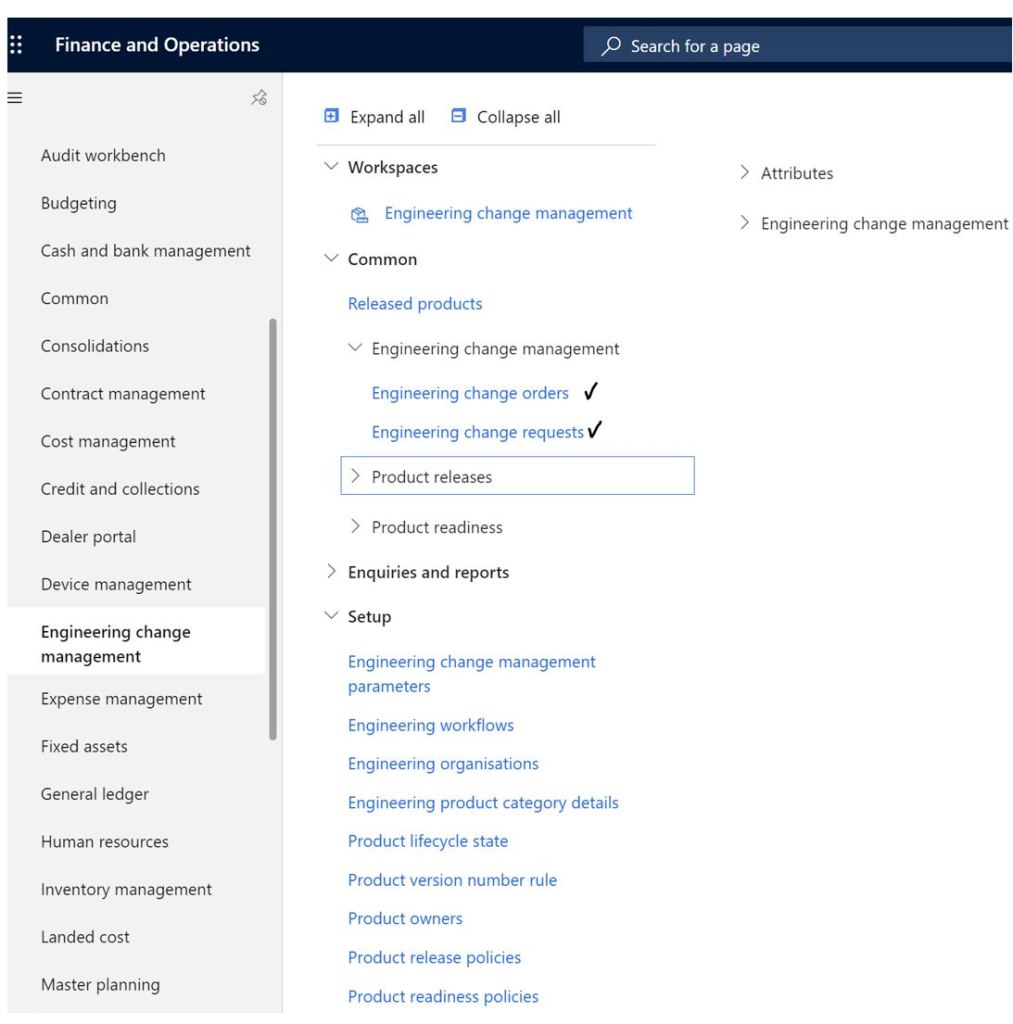

ECM

It is a version control management system which is valid for manufacting organizations who maintain BOM and Route in D365. Following is the summary of features:

- Product Lifecycle The lifecycle of the product can be tracked from the product.

- Engineering change requests Any change in the BOM and Route can be initiated and sent in workflow for approval.

- Engineering change orders Changes in the BOM/Route can be linked to change requests and sent into workflow and versioning can be maintained.

See more details on Microsoft document page.

Engineering change management overview – Supply Chain Management | Dynamics 365 | Microsoft Docs

I hope your liked this blog and the content. Thanks for your time.