IFRS 8 and IAS 14 demands certain types of organizations to report their financials per segment along with a consolidated view of the organization. So it is very critical for the business to tag their all the transactions with the reportable segment (which is known as financial dimension in D365). In my experience, it has been always a challenge to decide the number of dimensions and what dimensions will be mandatory for each type of accounts. Generally, the CFOs are very clear how do they want to report their profit and cashflow as the stock market is always after cash and profit but when it comes to balance sheet, they tend to cut short the dimensions need. I have see organizations which don’t care about reporting assets/liability per segment and keep everything under ‘corporate’ or ‘head office’ dimension. But there is still requirement to meet IFRS 8 and IAS 14 at the year end or quarterly for several countries.

Secondly, large organisations want to keep the reporting very transparent for each product line or business line so that it is easy for them to sell that business line. Investors will not get comfortable if the don’t see that segment separately. Definitely, there are valuation companies who deal with mergers & acquisitions but they will also need to dig deeper into your books for valuation which can be a cakewalk if your segment reporting is robust.

Generally this type of reporting was done offline or with some magic working in excel but with D365 you can do without any hassle. Yes you heard it correct, it is just a small trick which can save hundreds of hours for your team. It is called ‘Inter-Unit Accounting’

Inter-Unit Accounting

This feature is one of my favorites in D365. Many of our clients had a requirement to have segment wise balance sheet. The segment can be a business unit, department, Production site and so on. It was a common requirement from Profit & Loss perspective but maintaining balance sheets for each segment comes with a lot of overhead. For example- accountants have to make sure that they have to enter the same business unit dimension in the debit line and credit line while posting a transaction.

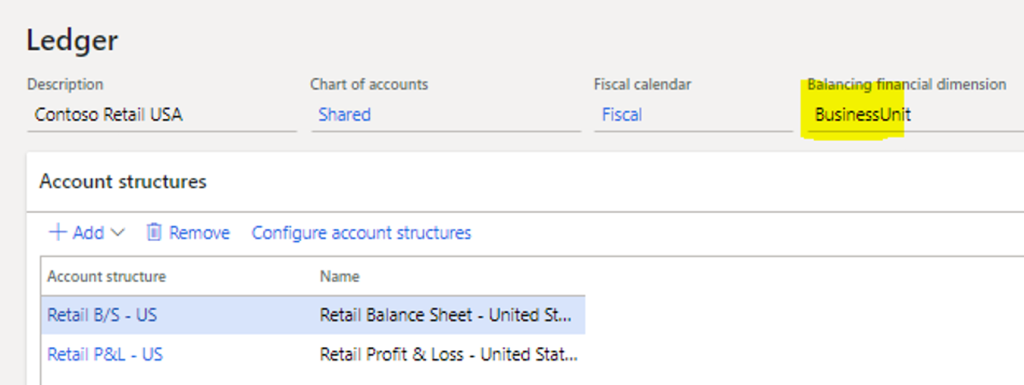

- Balancing financial dimension

Define the dimension which is required for balance sheet. In the example below, ‘business unit’ has been set up as a balancing dimension. Please note, you can choose only one dimension to get the balance sheet. If the management wants to get balance sheet based on business unit and department, it will not be possible.

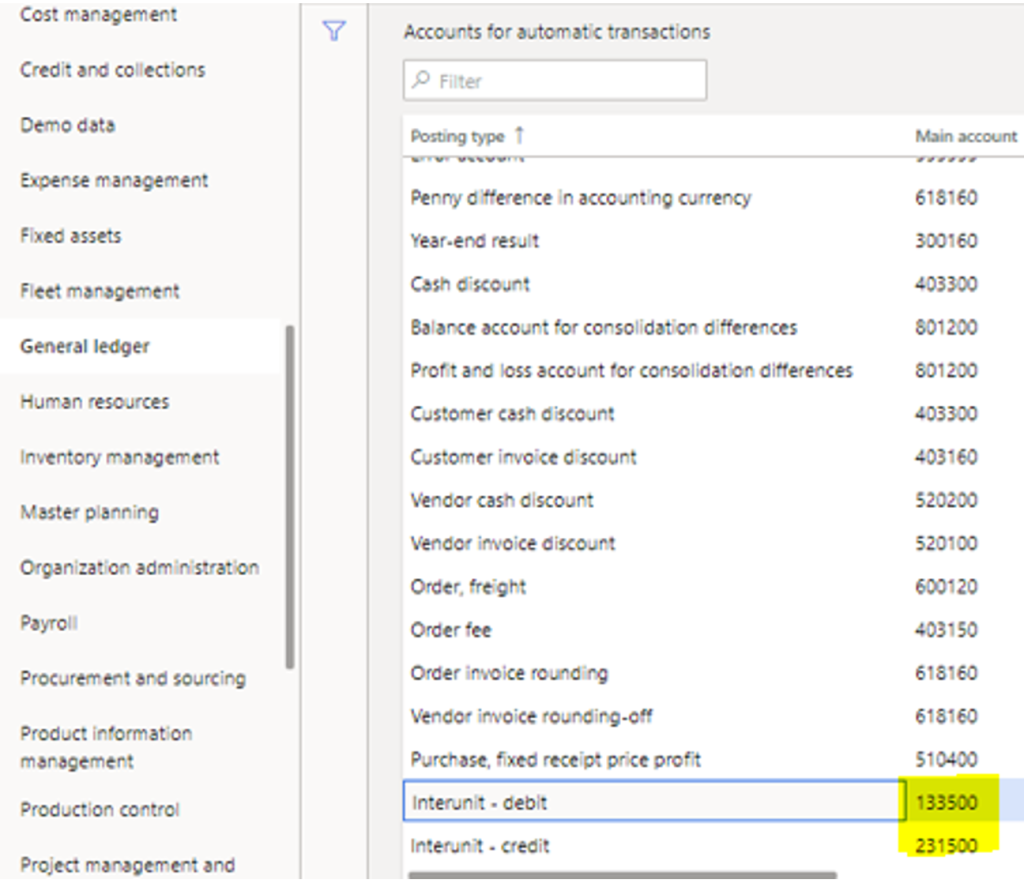

2. Define the debit/credit accounts for balancing.

You might need to create these two new accounts in your chart of accounts if you don’t have these already. They will be the balancing account or you can say that they will be used to complete an accounting entry at the segment level.

3. Another important thing to note is that when you enable a particular segment as a ‘balancing financial dimension’ in the ledger, you must make sure that this dimension should be mandatory for every transaction. Technically, you can make sure of this control using the ‘configure account structure’ in general ledger setup.

See the example below, there are two account structures in this entity, and both have ‘business unit’ as a mandatory dimension to enter.

Technically, you just must make sure that ‘allow blank value’ is not checked for any of the account structure for that segment.

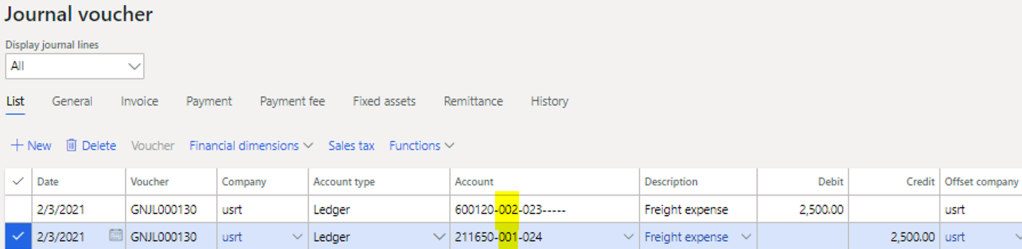

Let’s see this inter-unit accounting now in action after we have configured everything required.

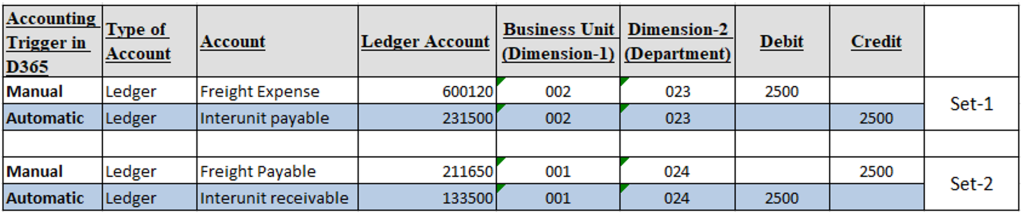

We entered a voucher with two different business unit (e.g., 002 and 001 in the example). Obviously, when you post the voucher the debit will go to 002 and credit will go to 001 which makes creates the imbalance at unit level.

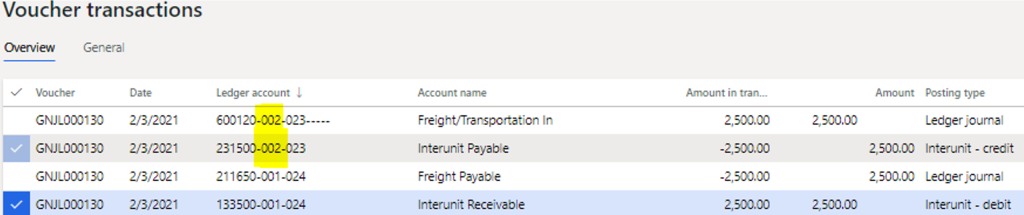

But as we have configured the inter-unit accounting and business unit is defined as balancing dimension, any imbalance at the BU level will be balanced by the newly created accounts. See the below voucher after posting in D365, there are two extra lines which just to balance.

To make it easier, see the same data in the below grid. Set-1 represents the set of lines which are balanced at 002 level. Debit is under ‘Freight expense’ and credit is under ‘Interunit payable’ account. If you just see the balance sheet of ‘002’ business unit, you will see that there is a liability amounting to $2,500 under ‘interunit payable’ account.

Similarly, if you analyze the balance sheet of ‘001’ business unit, you will see an asset of $2,500 in the name of ‘interunit receivable.’

Hope you liked this simple tip in D365! Send me message if you like to hear more on this or you have any feedback